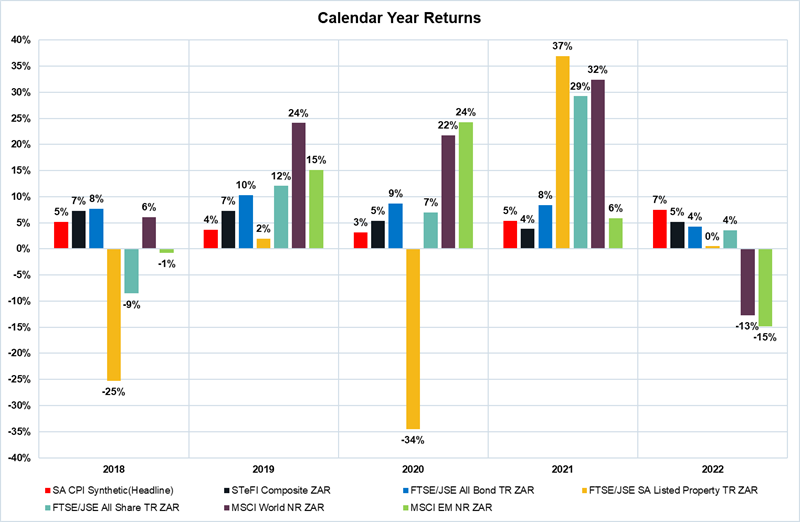

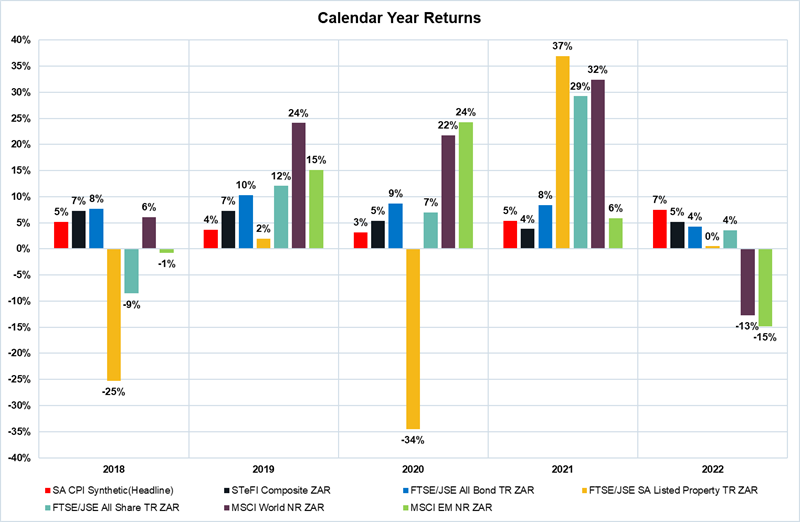

From a return perspective, it wasn’t all doom and gloom for South African investors. While none of the asset classes observed were able to beat inflation in 2022, the late rally in the fourth quarter ensured capital losses suffered during the year were recouped by year-end. Global markets didn’t fare as well, with a traditional 60/40 (equity and bonds) portfolio returning -16% in dollar terms as global markets slumped. After many years of strong gains from global investing, it was local assets that drove returns for South Africans in 2022 as both developed and emerging markets suffered losses. In summary, ‘local was lekker’ in 2022.

Source: Morningstar, January 2023

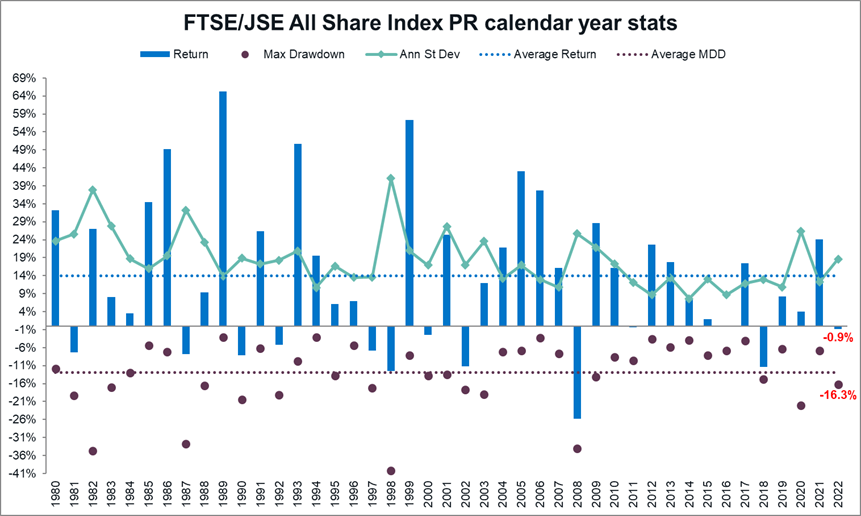

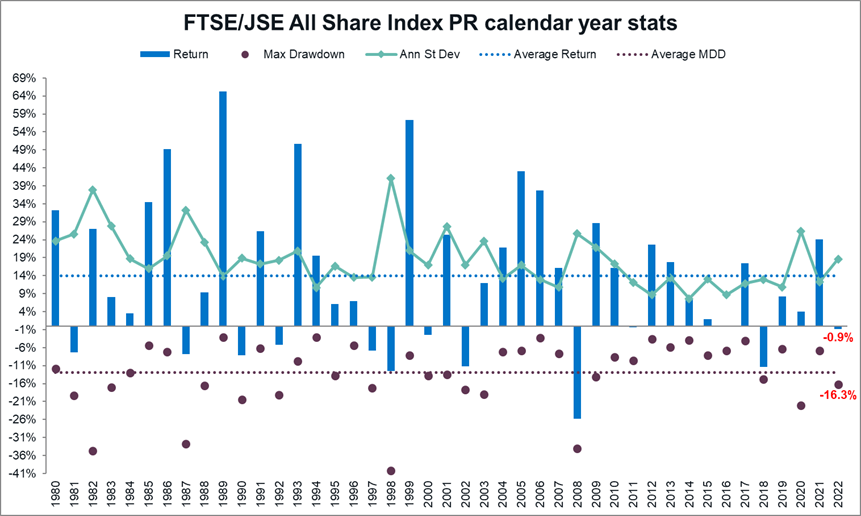

2022 was most certainly a busy year for headline writers and news agencies, but do any of the events observed or the market moves suddenly cause one to abandon one’s investment plan? We don’t think so. As illustrated below, markets fall every single year without fail; sometimes we notice it and sometimes we don’t.

While 2022 was event-filled and volatile, it was by no means a massive outlier in the data. We experienced below-average returns and above-average volatility. This is stark compared to 2021, where the opposite was true. Upon closer inspection one can see that the average return rarely exists over time, but to achieve the long-term return, one must remain invested even though calendar-year returns vary from year to year. While volatility drives short-term declines, it also drives long-term return-generation. Poor investor behaviour is a bigger risk to an investment than volatility. Emotional reactions during uncomfortable times could lead to poor behaviour at the wrong time, and being under-invested when markets eventually recover.

Source: Bloomberg, Glacier Invest, January 2023