Why Use the Glacier Invest 6% Real Income Solution?

This portfolio has a higher volatility than the Glacier Invest 5% Real Income Solution, but although its underlying assets reflect an aggressive portfolio, the risk is less than the category average of the Worldwide Flexible category3. This portfolio has more offshore exposure, so it is suitable for clients who want to take on more risk over the long term.

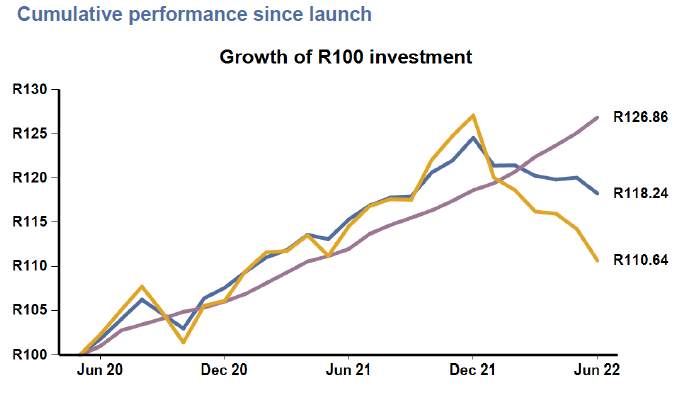

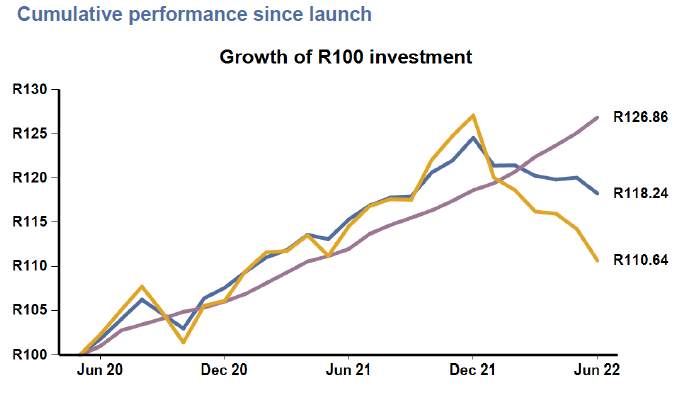

The portfolio has outperformed the Worldwide category since its launch, with far fewer drawdowns during tough times (see the blue versus yellow lines in the graph below). The destruction of global markets during the first half of 2022 is evident, but also the resilience of the Real Income plus 6% during such volatile periods. The graph below is until 31 June 2022.

These wrap funds present ideal opportunities for living annuity clients, and can be combined with one another, with other wrap funds, and other funds on the platform. However, the Glacier Invest Real Income Solutions could easily do the job for post-retirement income sustainability.